Home / Issuing / Quick Start Templates

AP Automation

Before creating an AP Automation program, you must complete product enablement steps with the Highnote team. For more information, contact support@highnote.com.

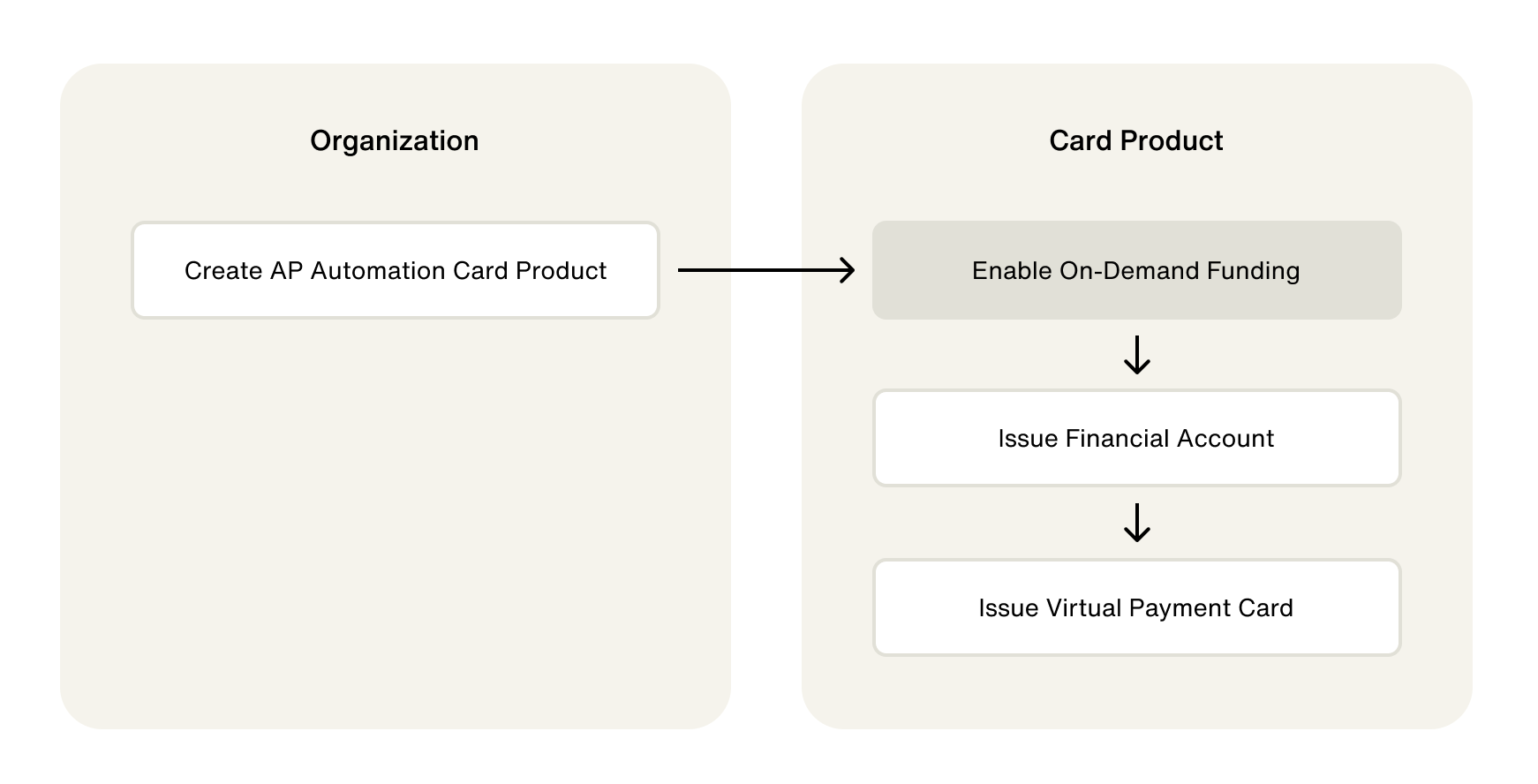

An AP Automation Card Product allows you to issue cards funded from a Financial Account owned by your business. AP Automation cards are Virtual Payment Cards that you can make available on your app or website. They are issued for specific transactions with Authorizations controlled by spend rules and/or collaborative authorization.

This guide provides an overview of how an AP Automation Card Product is set up and example queries you can use in your Test Environment.

In the Test Environment, there are two methods for creating an AP Automation Card Product:

- Using the Highnote Dashboard

- Using Highnote's GraphQL API

You can use the following mutation to create an AP Automation Card Product using the API:

AP Automation Card Products use On-demand Funding to fund Account Holder Financial Accounts. At Card Product creation, a Product Funding Account will also be created to use as the Source account for On-demand Funding.

When enabling On-demand Funding, you have the option of enabling Pseudo Balance. Pseudo Balance is an optional feature that lets you set a spending balance on a Financial Account. This ensures Account Holders cannot spend over a specific balance amount. A Pseudo Available Cash ledger keeps track of the spending balance. Highnote checks this ledger when a transaction is initiated and automatically declines transactions over the allocated balance. Highnote also checks the balance of your Source Financial Account during authorization.

If Pseudo Balance isn’t enabled, Highnote checks the balance of your Source Financial Account during authorization.

Use the following mutation to enable On-demand Funding and use a boolean value to enable Pseudo Balance optionally:

Financial Accounts hold the balance for Payment Cards. The applicationId needed to issue a Financial Account will be provided by the Highnote team during Card Product setup.

Financial Accounts have an externalId field that allows you to associate the Highnote Financial Account to an entity in your system. Highnote will automatically generate one if you do not pass an externalId when creating a Financial Account.

Use the following mutation to issue a Financial Account:

If you enable Pseudo Balance for your AP Automation Card Product, you must initiate a Pseudo Balance Update to set or update the Pseudo Balance on a Financial Account. After setting or updating a Pseudo Balance, you should query the balance update to ensure correct ledger balances and validations.

Use the following guides for Pseudo Balance Updates:

Once you have created and funded the Source Financial Account, you can issue a Payment Card. All Payment Cards start as Virtual Cards and can later be ordered as Physical Cards.

Selecting the number or cvv fields requires that you are PCI compliant.

Highnote recommends using the Card Viewer SDK to securely display payment card data and and reduce PCI burden.

To display an account holder's primary account number (PAN) and security code (CVV), you can use the API to fetch them using the following query:

You can simulate a deposit into your Product Funding Account in the Test Environment. Simulating deposits does not require you to connect an external bank account.

Once you’ve issued a Payment Card, you can simulate transactions in the Test Environment to observe the behavior of different Transaction Events. To simulate a Payment Card initiating a transaction, simulate an Authorization using the Simulate Authorization guide.

Once you've completed the basics of setting up your card product, you can expand and test your integration further:

- Simulate transactions in the Test Environment to ensure your integration works.

- Create Spend Rules to control the way your cards can be used.

- Setup Notifications to automate your integration.